Tesco has launched an online marketplace, giving customers the option to buy thousands of third-party products alongside their groceries.

When it reaches full scale, the marketplace will make Tesco.com «a one-stop shop for everything customers need», the supermarket said.

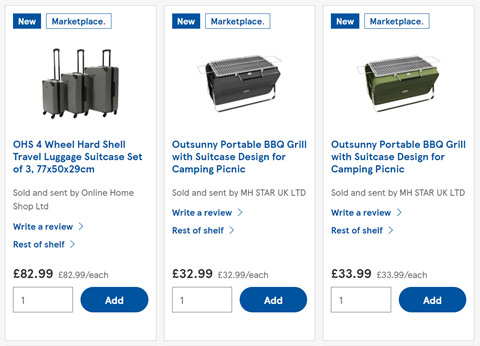

Today’s initial market launch [Tuesday 4 June] see around 9,000 products listed, in categories including garden, DIY, housewares, toys and pets. The products appear alongside Tesco groceries on Tesco.com and the Tesco app, but are delivered directly by the supplier.

«At the end of the day, it all comes down to giving our customers access to more than we have,» Peter Filcek, Tesco’s market director, told The Grocer.

“We looked at customer searches on our websites and found things that we just don’t carry in Tesco [stores] or online, and it sparked a series of thoughts about what we could do to open up that range, to give customers what they were looking for because they were really looking for all kinds of things.”

Last week, for example, the search term «no results» on Tesco.com was suitcases. Suitcases are available on the site from today.

“We are now able to meet truly quantified customer demand in a way that we could never mobilize a retail supply chain. Therefore, we will go where the customers tell us to go, where there are opportunities,» said Filcek.

How Tesco market works

Around 17 retailers are appearing on the market at launch – all of which have been vetted «to ensure they meet our strict requirements and standards», Tesco said. Several household brands are among those now available, including Tefal, Silentnight, Tommee Tippee and Charles Bentley.

Sellers will be continuously monitored based on factors such as delivery speed, returns and delivery success rates, and soon metrics such as customer ratings and reviews.

Customers pay for third-party items separately from their grocery store, and marketplace items have their own, separate shipping fees. For Anytime Delivery Saver customers or if the order is over £50 from the same seller, standard deliveries are free. Customers will be able to earn Clubcard points on all purchases. Items will be clearly marked as coming from third-party sellers.

Filcek said the market range and vendor base «should ramp up quickly over the summer» and will expand «as quickly as we see fit.»

«We want to become big enough to be a destination – to have critical mass and credibility in each of those categories. But not that big [shoppers] eventually you trip over non-essentials and it becomes a problem and enters [their] time. Equally, we don’t want to chase the number if it means bringing in vendors who can’t deliver on the promises we make to our customers, or who fail us on ongoing compliance, or have problems further down the line,” he said.

«So it’s definitely going to increase, but it’s going to increase at a pace that we’re comfortable with, that we’re confident is the right thing for our customers,» Filcek added.

The retailer is believed to have been working on the technology underpinning the market for the past two years. The launch follows a trial phase with Tesco colleagues over the past months, to test and learn how customers will use the platform. The grocer was the first to report that the supermarket was gearing up for an October launch, and that it had built a team responsible for recruiting retailers and working with them on «assortment, merchandising and promotional strategies».

A job listing for the role at the time said the market was a «key pillar» of Tesco’s strategy to be «easily the most affordable» grocer – a strategy set in late 2021 to serve customers «wherever, whenever and however they want to be served ”, where online plays a major role.

Tesco Direct 2.0?

The marketplace model is not new to Tesco, which in 2012 opened up its grocery-free Tesco Direct offering to third-party sellers. Tesco Direct ceased trading in July 2018, with the company saying there was no prospect of the loss-making concern becoming profitable. Along with hundreds of job losses, its closure saw around 300 retailers lose a small but solid sales channel.

Analysts argued that Tesco Direct was too protectionist when it came to the retailers it would take on, with excessive caution about the list of products that could compete with its own.

«Things have moved on from Tesco Direct,» Filcek said. «Our online business is significantly different from what it was before. We’re currently shipping 1.2 million orders a week and over that time we’ve invested and iterated in our retail platform, in our online shopping experience and that’s what we built the marketplace into.

“Tesco Direct was a separate website, with its own application, completed by Tesco. This is fully integrated into our dotcom buying experience and sent by the seller. So, a much easier buying experience, much more organic and easier to discover, but also a much more scalable business because everything comes from the seller,” added Filcek.

Recently, Tesco launched an online marketplace – Tesco Exchange – which allows suppliers to cut costs and food waste by selling or donating excess stock to other producers. The service, which launched in November, is available to more than 3,500 Tesco suppliers. However, no direct sales are made on the platform, with arrangements between parties who buy and sell privately.

Other supermarkets and retailers have launched marketplace models, including Walmart, Kroger, Auchan, Carrefour, Ahold Delhaize and Boots.

Asked if Tesco.com would now compete with Amazon, Filcek said «there is a difference».

“What we’re doing at Tesco is really focusing on what we believe Tesco customers want and trying to find the balance between scale and quality and trust. Our launch is nowhere near Amazon’s scale. We really try to achieve those ratings in performance, quality, trust and that will always be our fence, it will always be our slogan,» he said.

«We have no ambition to copy anyone else. In fact, we’re trying to do something a bit unique and find that balance of an established grocer with an omnichannel market that offers what you might look for somewhere like Tesco, but doesn’t go to the nth degree, doesn’t sacrifice ease of experience or trust in the pursuit of scale. «