- CryptoQuant data shows that the exchange balance of Bitcoin and Ethereum is in decline.

- Technical analysis indicates significant price movements for both cryptocurrencies if key resistance levels are broken.

Bitcoin [BTC] it was trading at just under $70,000 at press time, reflecting a modest 2% gain over the past 24 hours, though still below its March peak of over $73,000.

This continued growth from the asset is part of a larger narrative that highlights the complexity of the crypto market.

In contrast, Ethereum [ETH] it showed remarkable stability, maintaining a position above USD 3,800. This persistence comes despite a slight drop of 2.5% over the past day, stabilizing with a minimal gain of 0.7% today.

Ethereum’s price stability indicates sustained interest in the asset amid fluctuating market conditions.

Changing Bitcoin and Ethereum Markets

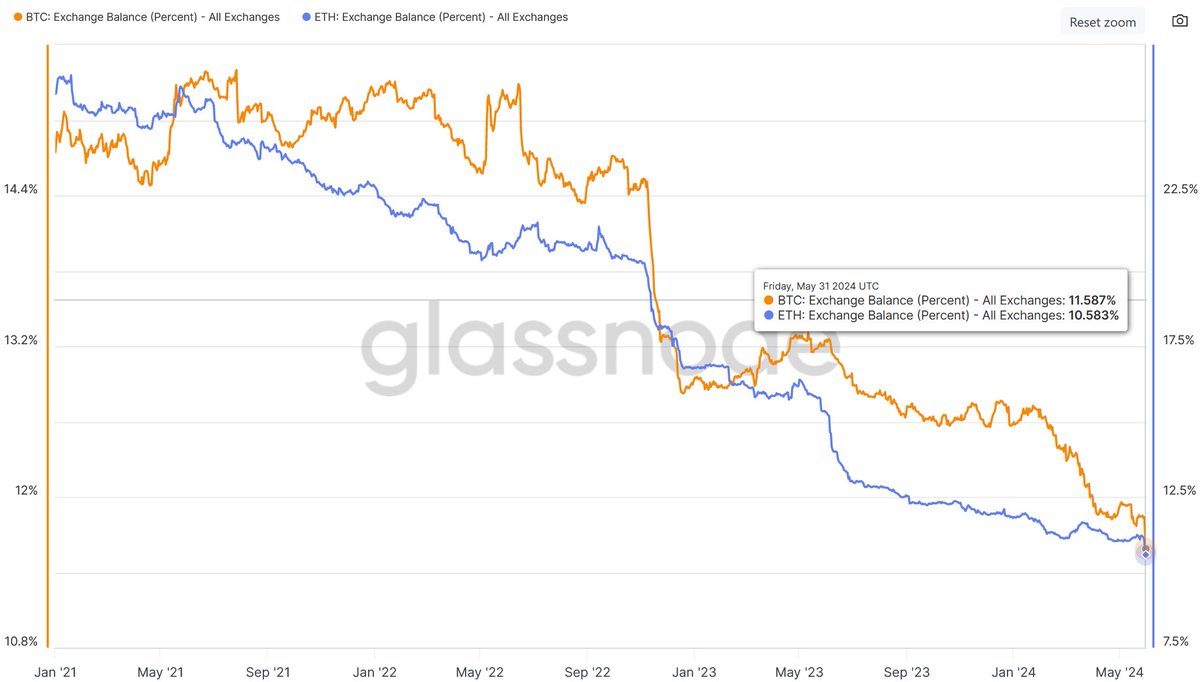

Recent analysis by Leon Waidmann of BTC-ECHO discovered that both Bitcoin and Ethereum witnessed their lowest exchange balance levels in years.

More specifically, the presence of Bitcoin on the exchanges decreased to 11.6%, while Ethereum fell to 10.6%.

Source: Leon Waidmann at X

This trend indicates a significant movement of these assets from exchanges and potentially indicates a strategy among investors to hold onto their coins for a longer period of time.

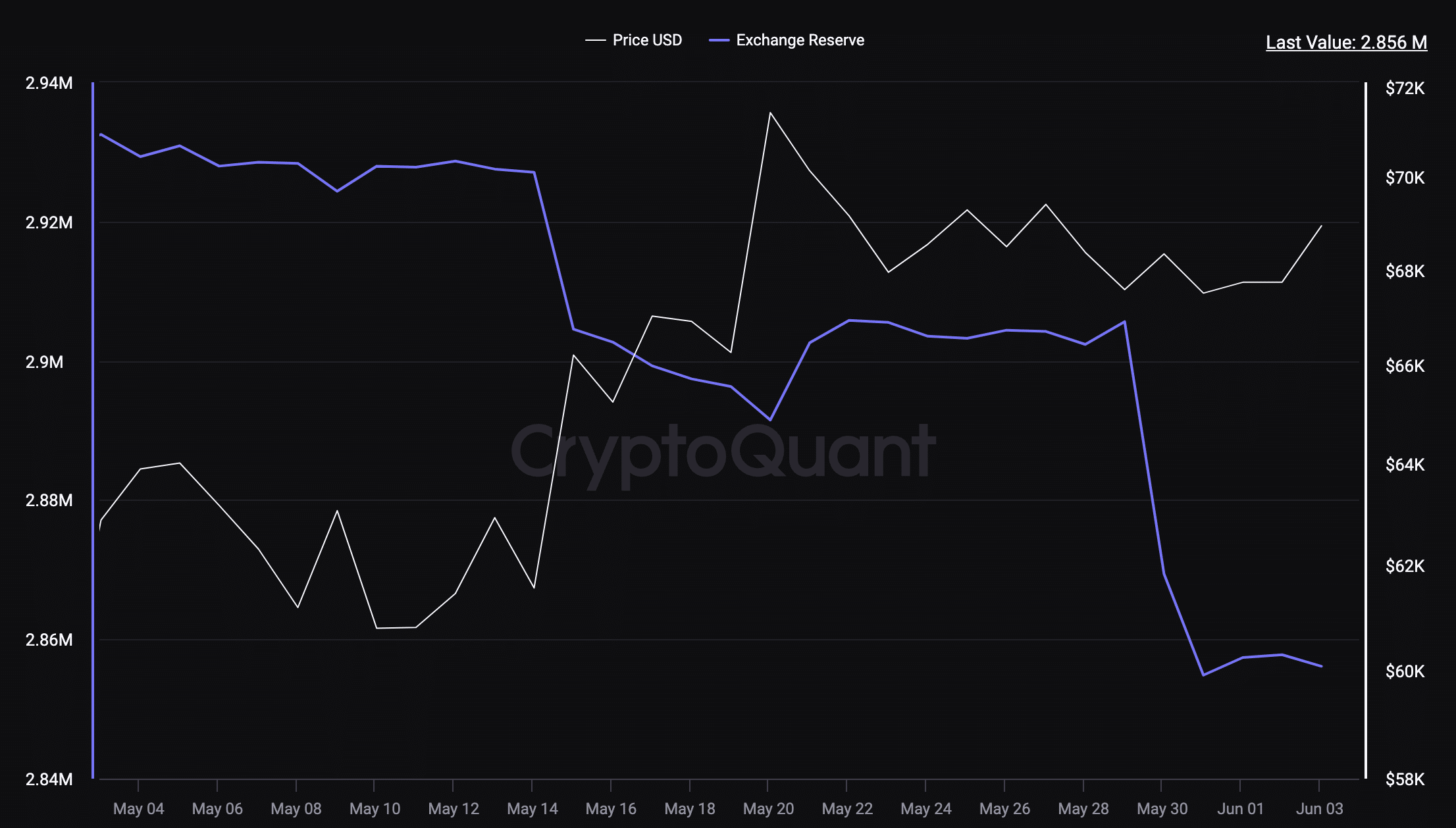

Source: CryptoQuant

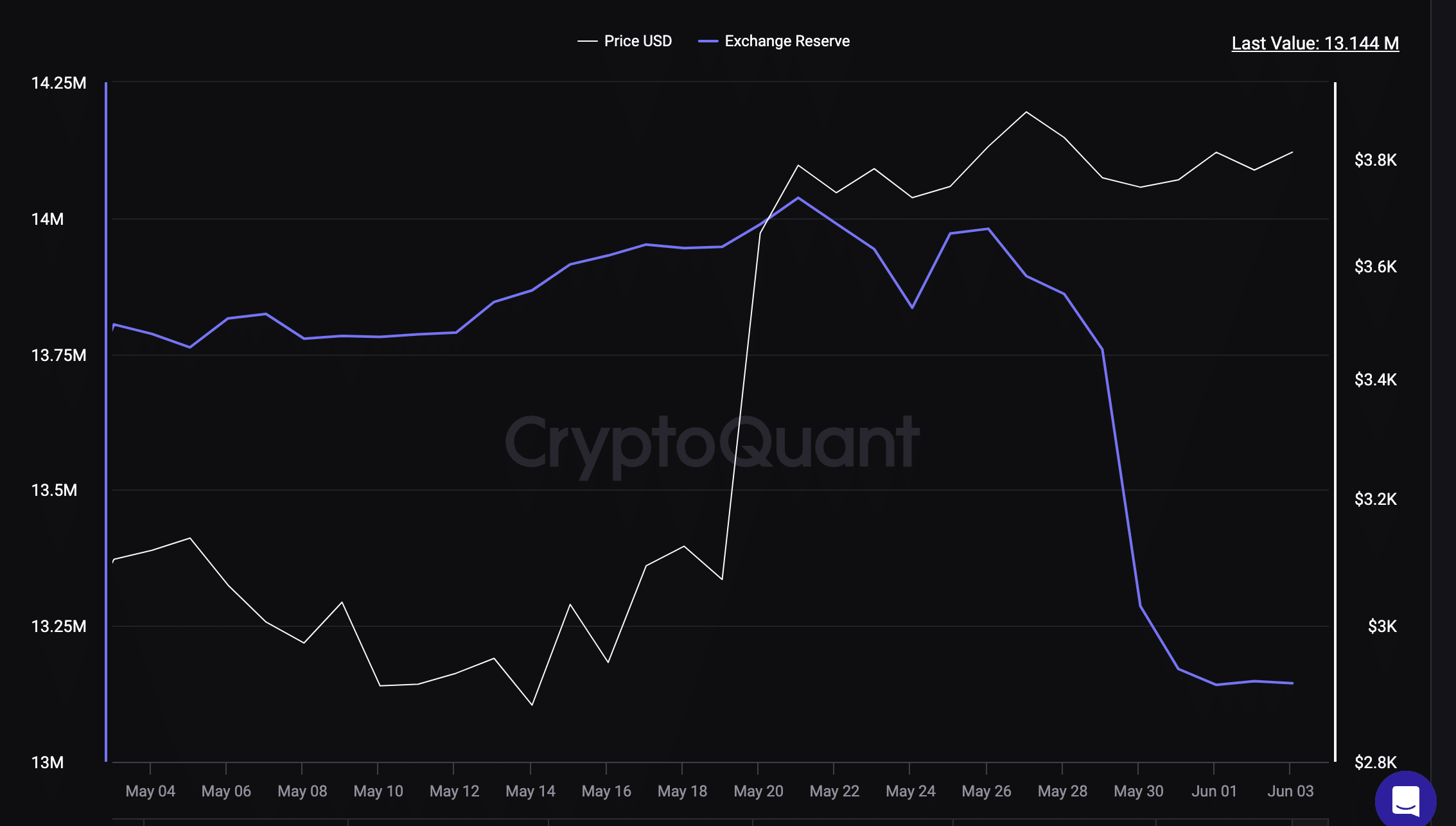

AMBCrypto survey of CryptoQuant data he additionally revealed a significant outflow of these cryptocurrencies from the stock exchange.

Over $5 million worth of Bitcoin and over $1 billion in Ethereum have been delisted since the beginning of May.

This move is noteworthy as it follows the approval of spot Ethereum ETFs in the US, hinting at a possible supply reduction on the horizon.

Source: CryptoQuant

A decrease in foreign exchange reserves implies that fewer coins are now available for immediate trading, indicating a potential increase in price due to scarcity.

Waidmann predicts that this will lead to a reduction in supply, urging investors to prepare for significant market movements, noting:

“The whales continue to pile up. A shortage of stock is coming. Get ready for the next big move.”

Market dynamics and technical analysis

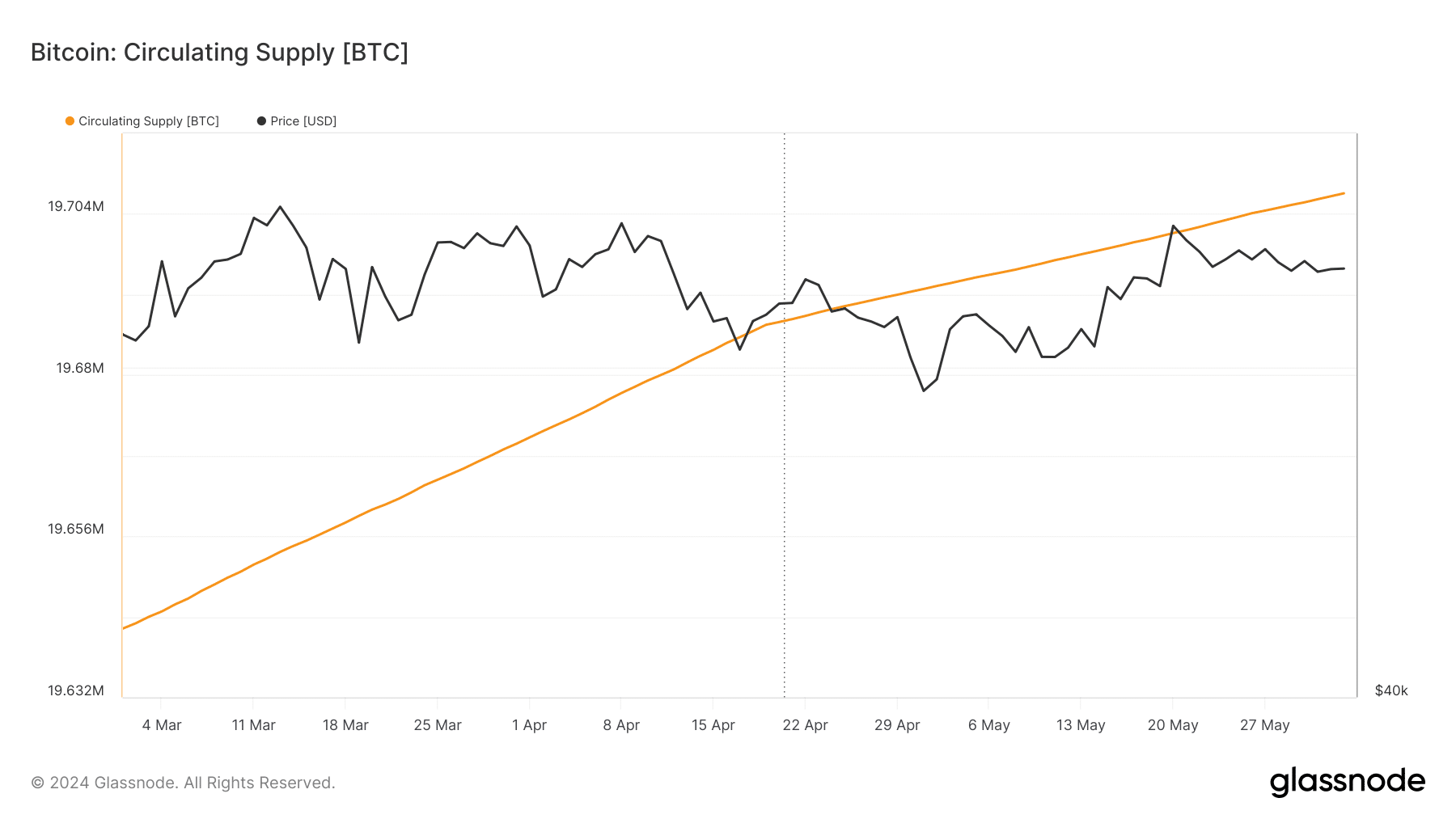

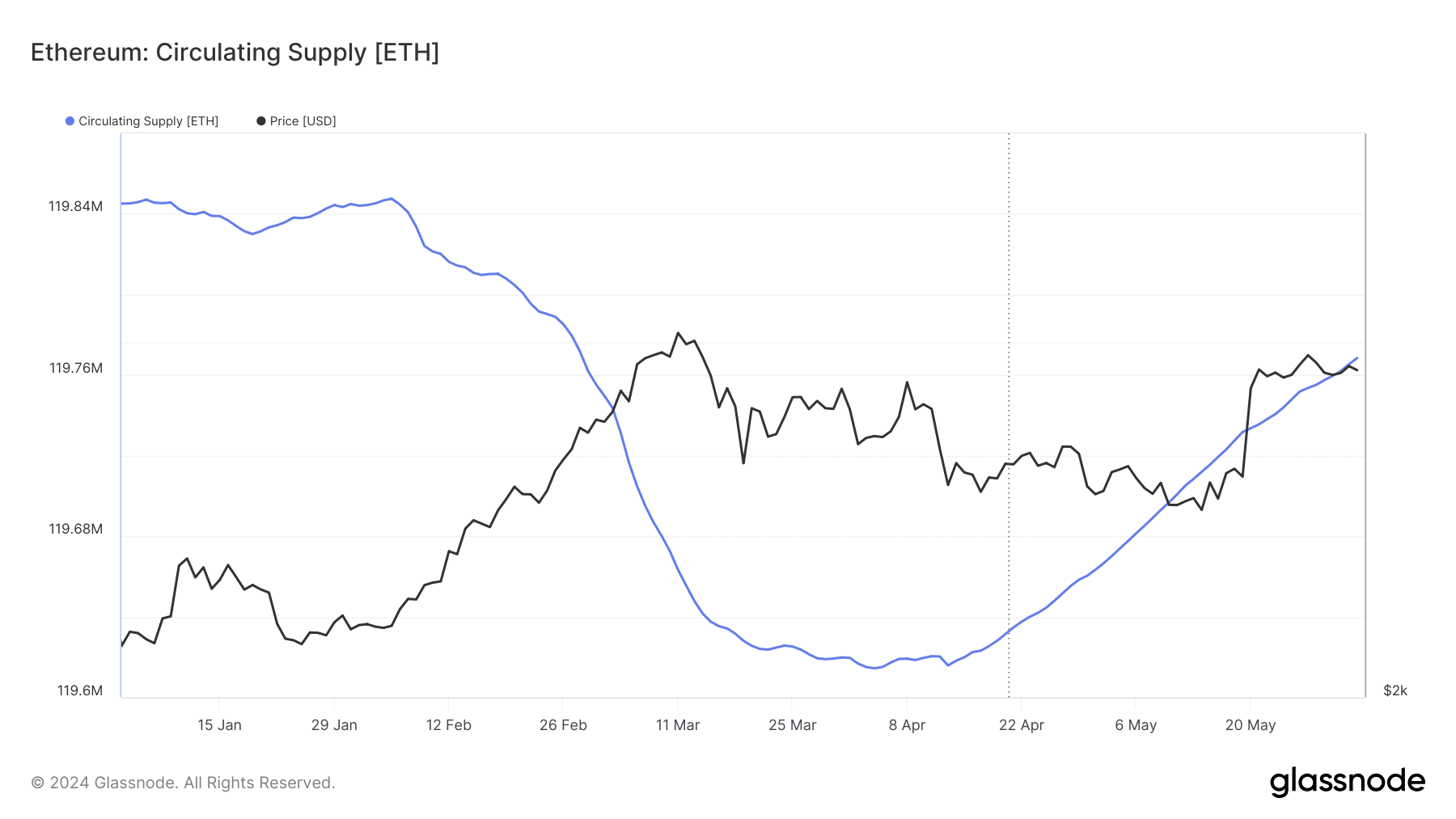

However, Glassnode data presents the opposite view, showing an increase in circulating supply for both cryptocurrencies, suggesting that despite reduced exchange availability, overall market supply remains high.

Source: Glassnode

This scenario sets the stage for possible price corrections if demand fails to keep pace with rising supply. However, current market indicators suggest that demand is keeping pace, as prices have not fallen significantly despite increasing supply.

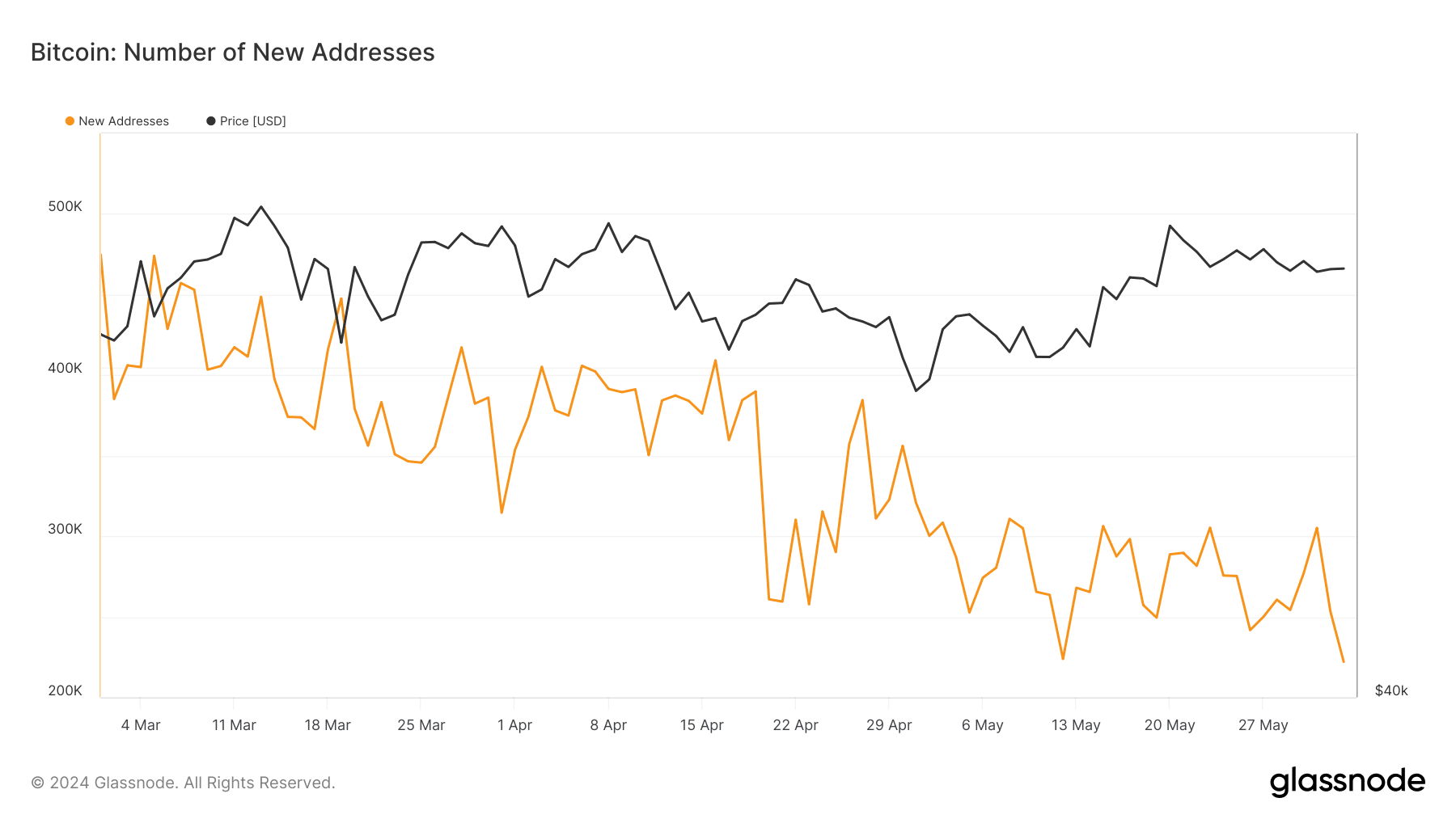

Source: Glassnode

Meanwhile, there is a drop in new addresses for Bitcoin and Ethereum which could indicate a decrease in interest among new investors, which could affect future demand.

Source: Glassnode

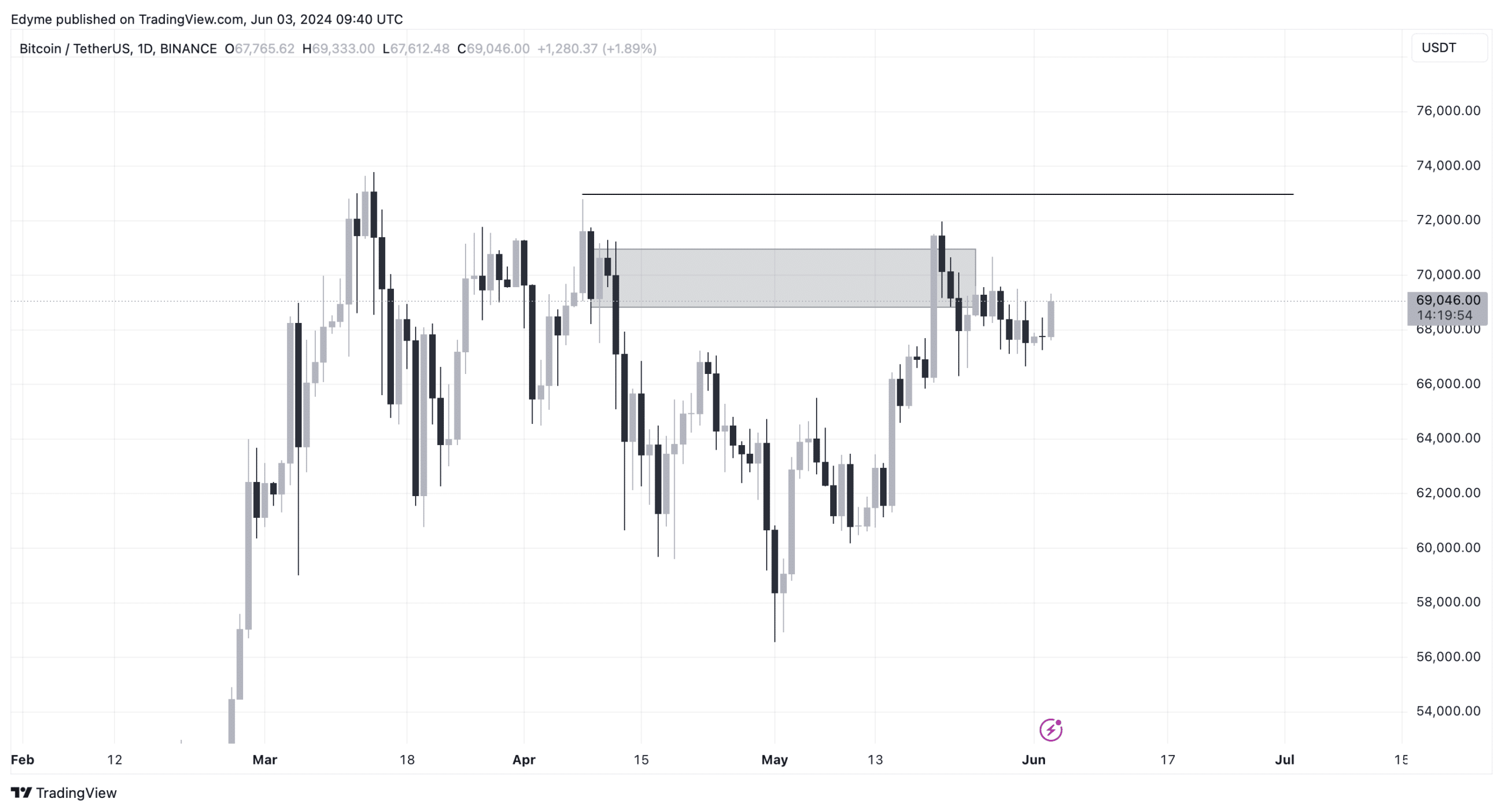

Meanwhile, technical analysis of Bitcoin and Ethereum charts reveals a potentially intriguing performance on the horizon.

Focusing on Bitcoin’s daily chart, it illustrates a pattern where the cryptocurrency has broken through lower support levels, recently reversing into a major supply zone.

Source: TradingView

This movement usually signals the continuation of a downtrend. However, if Bitcoin crosses the $72,000 mark, breaking the previous lower high and negating the bearish trend, it could signal a reversal to the uptrend.

AMBCrypto, citing an analyst from XBTManager at CryptoQuant, reported that Bitcoin is poised for a significant rally. The analyst suggests,

“Bitcoin is gathering strength for the next rise. When he gathers enough strength, a sudden ascent seems inevitable. It seems likely that increases similar to those seen in Q3-Q4 will continue.”

Is your portfolio green? Check out the Bitcoin Profit Calculator

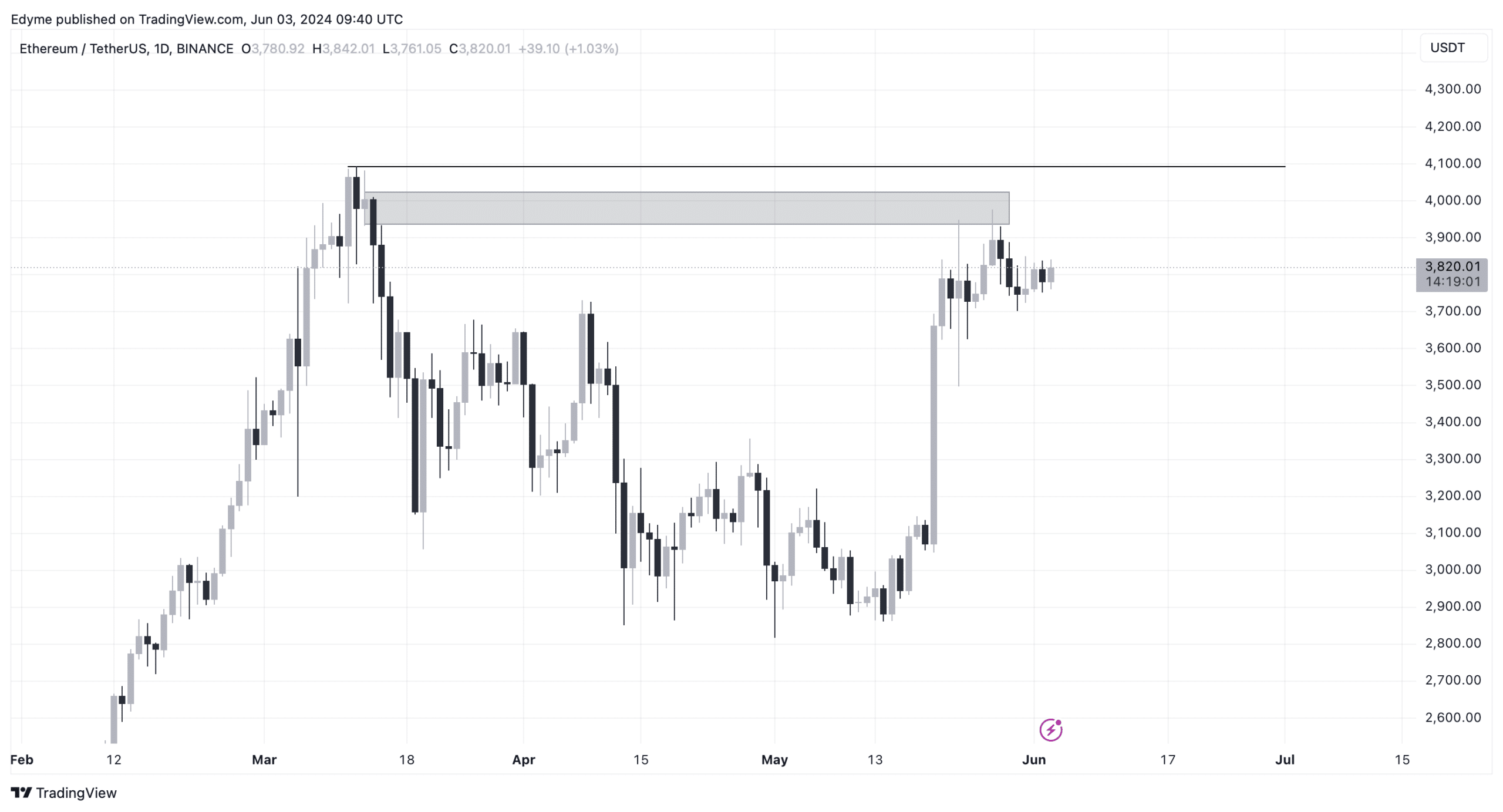

A similar pattern appears on Ethereum’s daily chart. Ethereum recently entered a zone of high supply, indicating an upcoming selloff.

Nevertheless, if Ethereum crosses the $4,000 threshold, breaking the recent lower high and reversing the current sell signal, it could pave the way for an upside move.

Source: TradingView